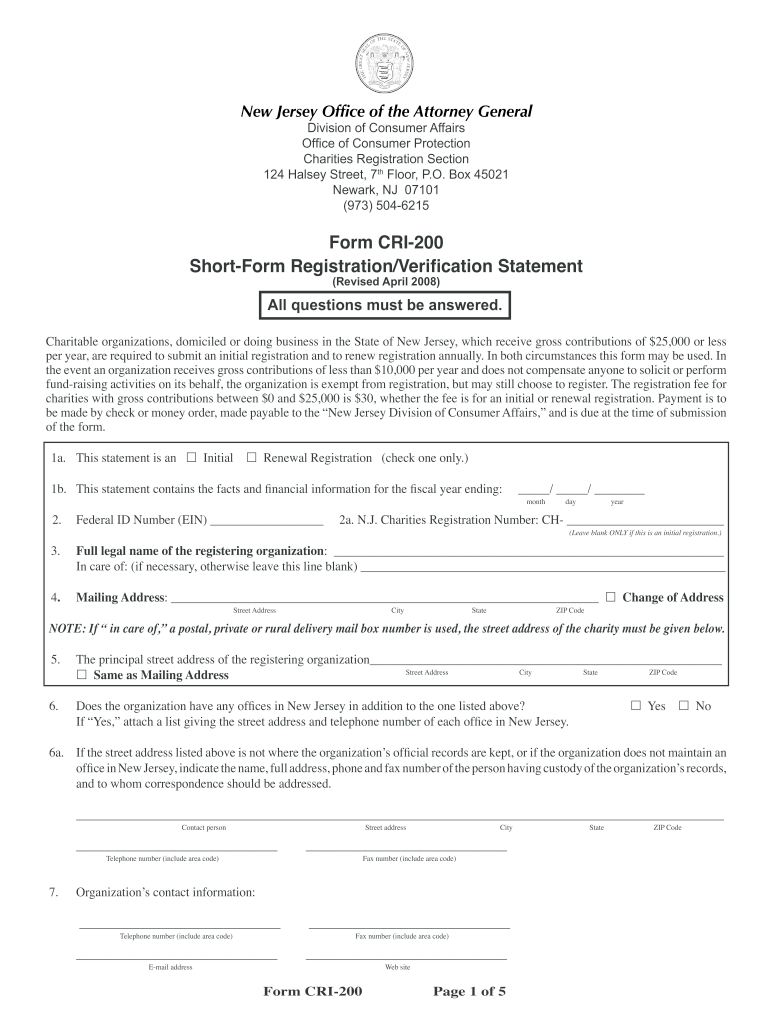

Who needs Form CRI-200?

The Form CRI-200, Short-Form Registration/Verification Statement is a document that should be completed and submitted by every charitable organization that is doing business or is located in the State of New Jersey and its gross contributions reach or don’t exceed $25,000. Actually, this particular form should be issued in either of two cases: as an initial registration or, as the registration renewal. In case the gross contributions of a charity organization do not reach $10,000, and the organization does not pay anyone for performing their fund-raising activities, it is not obliged to register, yet may decide not to do so.

What is the purpose of CRI-200 Form?

The form is to be filled out by a charity organization so that they are able to register their business activity with the Division of Consumer Affairs Charities Registration Section. The purpose of the Form is to provide enough information necessary to register the charity in a legal way that will further enable making contributions properly.

Is CRI-200 accompanied by other forms?

If the CRI-200 is being submitted as an initial registration form, it has to be accompanied by several attachments: copies of the charity's by-laws, articles of incorporation, IRS determination letter and the latest filed IRS Form 990.

In case the organization has no opportunity to deliver any of the initial registration materials, they should provide a cover letter explaining the reasons for this.

When is CRI-200 Form due?

As it has been mentioned, the form is to be submitted annually. The initial registration must be claimed within thirty days after exceeding $10,000 in gross contributions within a year. Besides, it is not obligatory to wait until the end of the fiscal year, the form may be filed within the time required by the statute.

When a renewal registration form is concerned, it has to be submitted within six months following the end of the previous fiscal year.

How to fill out the CRI-200 Form?

The registration statement must be signed by two officers of the charity, it has to be submitted with the required registration fee (standard $30) and all the supporting documents.